Fascination About Fortitude Financial Group

Table of ContentsTop Guidelines Of Fortitude Financial GroupHow Fortitude Financial Group can Save You Time, Stress, and Money.Rumored Buzz on Fortitude Financial GroupEverything about Fortitude Financial Group

With the right strategy in position, your money can go better to help the organizations whose objectives are straightened with your values. A monetary expert can help you define your charitable giving objectives and integrate them right into your economic strategy. They can additionally advise you in proper means to optimize your offering and tax obligation deductions.If your business is a partnership, you will want to go via the sequence planning process with each other - Financial Services in St. Petersburg, FL. A monetary consultant can assist you and your partners understand the essential components in company succession planning, determine the value of business, create shareholder agreements, develop a settlement framework for successors, outline shift options, and far more

The secret is finding the appropriate monetary advisor for your scenario; you may end up interesting different experts at different phases of your life. Attempt contacting your monetary institution for referrals.

A Biased View of Fortitude Financial Group

Financial experts assist you choose about what to do with your cash. They assist their clients on saving for significant acquisitions, placing cash aside for retirement, and spending money for the future. They can also suggest on present economic and market task. Let's take a closer consider exactly what a financial expert does.

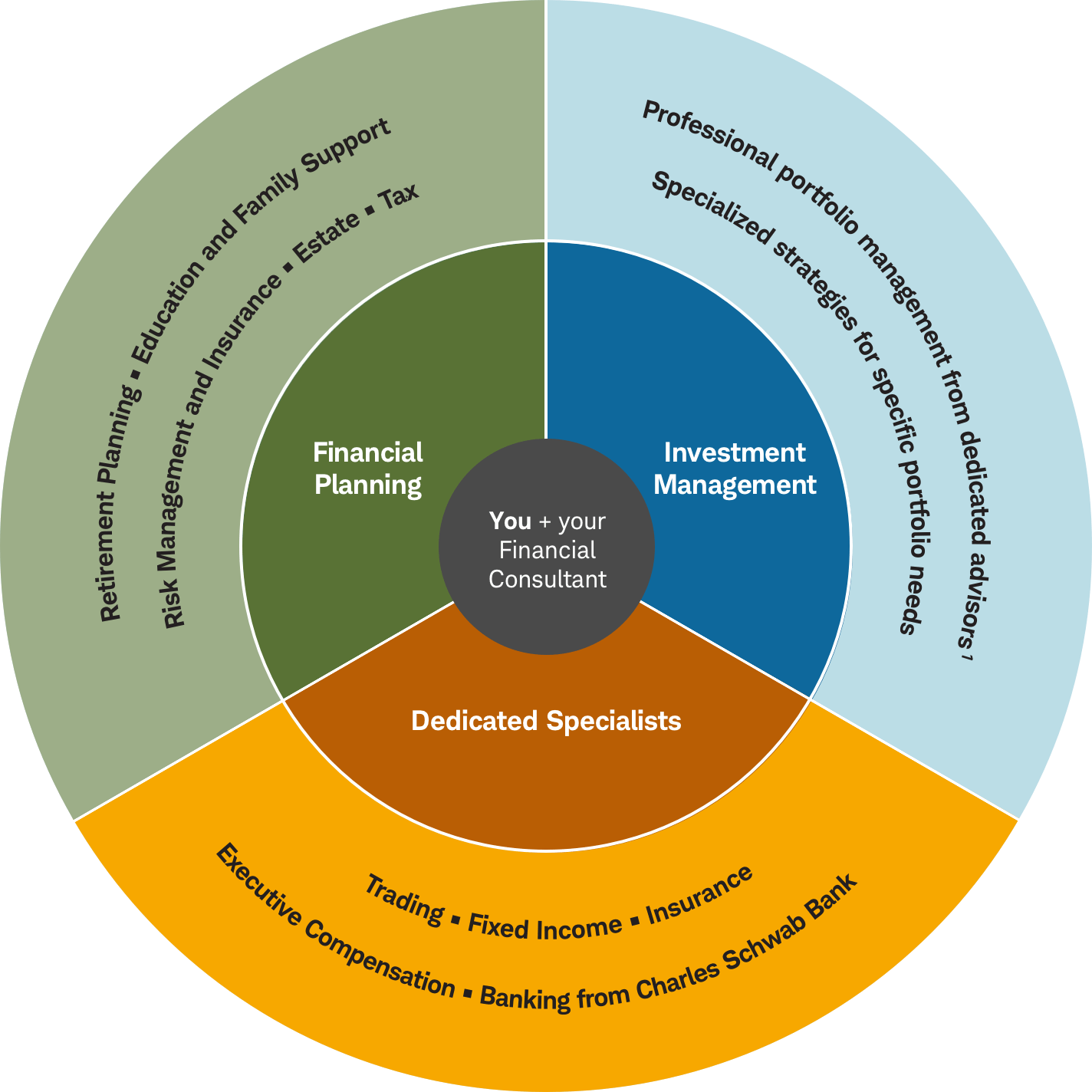

Advisors use their knowledge and competence to construct personalized monetary plans that intend to achieve the monetary objectives of clients (https://www.brownbook.net/business/52992085/fortitude-financial-group/). These plans consist of not only financial investments but additionally savings, spending plan, insurance policy, and tax approaches. Advisors even more check in with their customers often to re-evaluate their current circumstance and plan accordingly

Fortitude Financial Group for Beginners

Allow's say you intend to retire in two decades or send your child to a private university in ten years. To complete your objectives, you might require a competent specialist with the appropriate licenses to aid make these strategies a reality; this is where a monetary consultant is available in (Financial Advisor in St. Petersburg). Together, you and your advisor will cover numerous topics, including the amount of money you ought to save, the types of accounts you require, the sort of insurance coverage you must have (consisting of long-term care, term life, disability, etc), and estate and tax planning.

Financial experts give a selection of services to customers, whether that's providing reliable basic investment recommendations or helping within a financial objective like buying a college education and learning fund. Listed below, discover a list of one of the most typical services provided by economic advisors.: An economic consultant uses recommendations on financial investments that fit your style, goals, and threat tolerance, establishing and adjusting spending technique as needed.: A financial expert produces techniques to help you pay your financial debt and prevent financial obligation in the future.: A monetary advisor supplies suggestions and approaches to produce budgets that assist you fulfill your goals in the brief and the long term.: Component of a budgeting technique might include strategies that aid you pay for greater education.: Also, a financial consultant produces a conserving strategy crafted to your specific requirements as you head right into retirement. https://www.4shared.com/u/D8ZPMu7Y/cherylleemorales33702.html.: An economic expert assists you recognize individuals or companies you intend to get your legacy after you pass away and creates a strategy to execute your wishes.: An economic advisor gives you with the most effective long-lasting remedies and insurance policy options that fit your budget.: When it pertains to tax obligations, a financial advisor may assist you prepare income tax return, optimize tax obligation deductions so you get the most out of the system, timetable tax-loss harvesting safety and security sales, make sure the most effective use the capital gains tax rates, or strategy to decrease tax obligations in retired life

On the questionnaire, you will also suggest future pension plans and income sources, project retirement requires, and define any kind of long-lasting monetary commitments. In other words, you'll list all current and expected investments, pensions, gifts, and income sources. The investing element of the survey touches upon more subjective topics, such as your danger tolerance and risk capacity.

4 Simple Techniques For Fortitude Financial Group

At this factor, you'll also allow your advisor understand your investment choices. The initial analysis might additionally include an exam of various other monetary management topics, such as insurance problems and your tax obligation situation.

Comments on “All About Fortitude Financial Group”